Adjusting Sails: PE Firms After the End of Cheap Money

The era of cheap money that allowed Private Equity (PE) firms to acquire assets by leveraging cheap borrowing appears to be over. Jared Gross analyses the challenges and considerations for private equity investments in the face of this shift for JP Morgan, and highlights an emerging opportunity for smaller private equity strategies focused on operational improvements. PE firms have always boasted of their ability to cut costs and boost synergies across their portfolio firms, but in fact have often loaded acquired firms with unsustainable debt whilst extracting, rather than creating value. But perhaps the confluence of macro-economic volatility, rising interest rates and the availability of truly transformational digital technologies opens up a genuine opportunity to show what can be achieved to upgrade acquired firms and create genuine value.

Second Wave Digital Transformation Opportunities

Historically, PE firms have recognised the untapped value potential of many ‘analogue businesses’, often characterised by their lagging, siloed, low-tech operations. Digitisation has been one of the tools they have used in recent years to uncover that hidden value, but this ‘first wave’ digital transformation was too focused on buying tech rather than using it to transform operations and organisational design, which is where the bigger returns are to be found. PE firms have tended to rely heavily on external Digital Transformation consultants to do this, rather than building their own knowledge and capacity as part of their own operations, but that might change as digital transformation becomes a more effective intervention in acquired firms. Also, simply focusing on new tech means a 4-5 year lead time for a tangible improvement, but an average of 87.5% of digital transformations fail to achieve their objectives because digital transformation is not only about technology:

”Most digital technologies provide possibilities for efficiency gains and customer intimacy. But if people lack the right mindset to change and the current organisational practices are flawed, DT will simply magnify those flaws.”

Perhaps it is time for PE firms to differentiate themselves on the basis of their ability to accelerate digital transformation in acquired firms as a route to value, and create synergies across their portfolio by investing in common digital business capabilities that multiple firms can leverage.

The Role of a Digital Transformation Accelerator

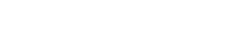

Rather than engage a large consulting firm at great cost, it makes sense for PE firms to get started with a much cheaper and more sustainable strategy of forming an accelerator or catalyst unit by bringing together leading advocates for change from within their portfolio firms, perhaps with some enablement support or external expertise. Previously, we helped a leading European industrial group do just that, creating a small core team connected to a growing network of digital passionates and change agents. Over more than five years, we supported that team in spreading good practice, applying lessons across the group and generally developing the capacity of the group to succeed with digital transformation over the long-term. Since then, we have evolved this practice to help group companies (or shared portfolios) develop a digitally-enabled service-oriented approach as a more efficient and flexible alternative to traditional internal bureaucratic functions. The idea here is to turn the back-end and support functions of a firm into a shared service platform to reduce overheads and create more opportunities for innovation and continuous improvement. Typically. this involves helping them create a two-tier shared service platform, with common services such as financial reporting, logistics, data analytics embodied in a shared group-level-platform that maximises automation at scale, and more bespoke services that support individual portfolio firms on top, but still potentially shareable where appropriate.

We have also used this model successfully in group companies that were previously siloed into vertical operations, but now seek to combine these functions (e.g. telecoms + media + consumer services) to create new cross-cutting or ‘combinatorial’ value propositions.

Don’t Forget the Basics: Cost-savings and Synergies

Long-term future fitness is a key goal, of course, but this model is also significantly more effective at doing the basics that PE firms claim as part of their value proposition. Cutting costs by cutting heads is a rather blunt instrument that does little to create operational efficiencies. In fact, there is usually a ton of waste and duplication of effort rooted in overly-bureaucratic practices that can be eliminated by digitisation and greater use of automation. Similarly, synergies should not be about blanket outsourcing or forcing each firm to use a lowest-common-denominator service centre; nor should it be about blanket imposition of “best practice” across different types of firm. Instead, by standardising underlying digital services and making them available as components to be re-used and re-combined, this platform business approach to digital transformation can uncover more meaningful and useful synergies. Private Equity firms that grasp this opportunity to transform acquired or investee companies by developing and accelerating their digital business capabilities can expect to enjoy competitive advantages and also to be less exposed to short-term economic headwinds. Steering away from just financial engineering, Private Equity firms should aim to consistently deliver business transformation across their portfolios, and to maximise synergies, innovation, and ultimately value creation. In-group digital business acceleration is the kind of force multiplier that can achieve this.